⚡ TL;DR:

In this longer-than-usual (but promise-it’s-worth-it) edition of the KYC Chronicles, I explore:

✅ How credit scores are calculated in the U.S. vs. India

✅ What factors impact your score on both sides of the planet

✅ How newcomers can build credit in the U.S. from scratch

✅ Why international credit scores don’t travel with you (yet)

✅ A look at what companies like Nova Credit are solving—and what still needs fixing

✅ An open invitation to collaborate on building a global credit passport 🧳

🎯 The Problem Statement

Imagine working for a decade, never missing a payment, and building an impeccable credit score only to land in a new country and be told you’re a financial nobody.

That’s what happened when I moved to the U.S. recently. My years of on-time EMIs in India meant nothing here. No credit history. No score. No access to a decent credit card without security deposits. And definitely no chance at low-APR loans.

The funny part? I knew exactly how credit systems worked. I’ve built them.

But starting from zero? That’s a whole different learning curve.

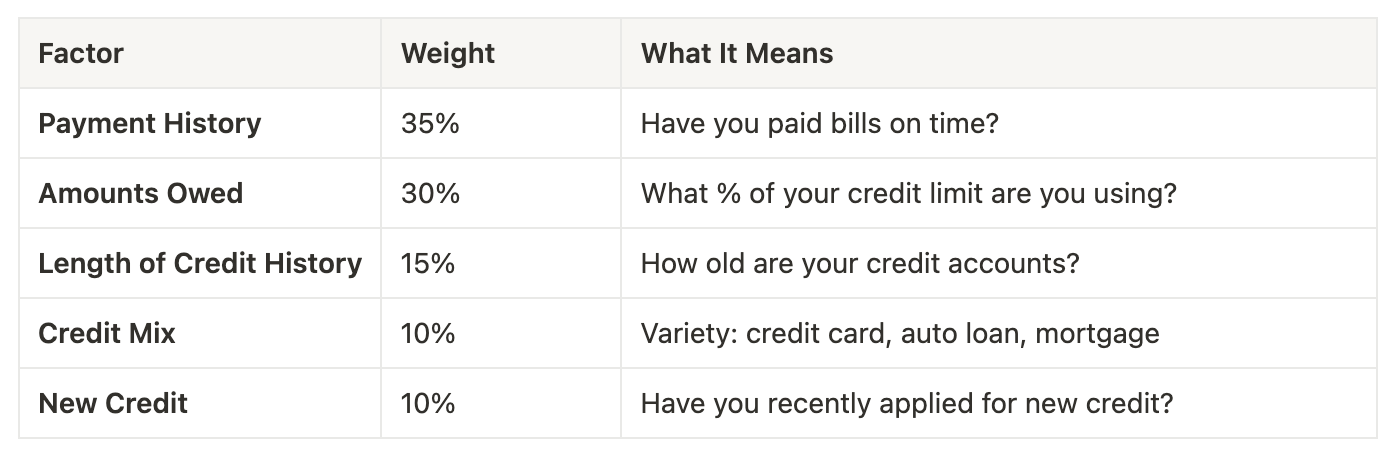

🧮 How Credit Scores Are Calculated in the U.S.

Here’s the FICO (and similar VantageScore) breakdown that most lenders use:

It’s very structured, very U.S., and very reliant on bureau-reported activity (Experian, Equifax, TransUnion).

What’s interesting is the growing inclusion of non-traditional data:

- You can now opt in to report rent payments (something I did with my apartment here)

- Utilities and telecom bills can count too (via Experian Boost)

- On-time subscription payments may soon follow

That’s a breath of fresh air. In India, this kind of data rarely makes it to the bureaus.

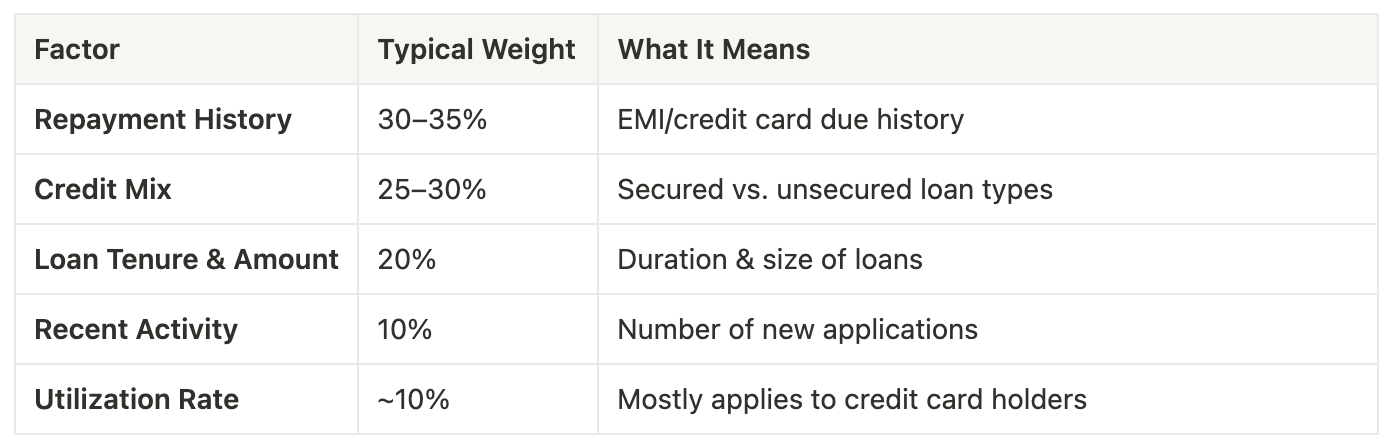

🇮🇳 How Credit Scores Work in India

The Indian credit scoring model (e.g., CIBIL, Experian India, CRIF Highmark) is conceptually similar, but more limited in input sources. Here’s a simplified breakdown:

Key differences:

- Rent, utilities, insurance payments? Not counted.

- Alternate data use? Still very limited, even among fintechs.

- Thin file customers? A huge problem. Especially in Tier 2/3 towns.

In short: India is catching up, but there’s work to be done on both inclusion and innovation.

🛠 How to Build Credit from Scratch

Whether you're a newcomer to the U.S. or a college student in India, starting from zero can feel like trying to enter a nightclub with no ID. Here’s what helps:

🇺🇸 In the U.S.

- Secured credit card: Put down a $200 deposit, get a $200 limit. Use and repay. Rinse, repeat.

- Credit builder loans: Offered by fintechs and credit unions. Pay monthly, get your money back at the end with a credit history.

- Authorized user: Join someone else’s card (with their permission). Their history reflects on your report.

- Report rent/utilities: Use tools like Experian Boost or RentReporters to report on-time payments.

Pro tip: Even if you don’t need a loan right now, start building credit early. That FICO clock starts ticking only once you open an account.

🇮🇳 In India

- Start with a credit card from your salary bank

- Apply for a consumer durable loan or a small personal loan

- Use BNPL responsibly (they’re now being reported to bureaus)

- Avoid multiple inquiries : shopping for loans aggressively can hurt your score

And always, "ALWAYS" pay on time. One late payment can ruin your score faster than you can say "CIBIL 620."

🌍 Why Credit Doesn’t Travel

Let’s say you’ve been financially disciplined for 10 years in India. You land in the U.S., apply for a credit card, and get offered:

- A $300 limit

- With a $39 annual fee

- And a 27% APR

Why? Because your Indian credit report might as well be printed in Sanskrit for U.S. banks. There’s no direct integration between countries’ credit systems. Each bureau is national, siloed, and (ironically) credit-averse when it comes to international collaboration.

This leads to:

- Duplicate identity verification

- Expats starting from scratch

- Lower financial access & higher friction for global talent

🧠 Who’s Solving This?

One name stands out: Nova Credit.

They’ve created infrastructure that helps newcomers port their credit history from India, Mexico, Australia, etc. into U.S. credit applications. It’s not perfect, but it’s a meaningful start. Some banks and landlords now use their “Credit Passport” during onboarding.

But here’s the white space:

- Coverage is still limited (only some countries)

- Real-time bureau sync doesn’t exist

- Data transfer still requires permission and standardization

- Fintech and lenders aren’t incentivized enough to adopt this yet

💡 What’s the Opportunity?

Imagine a system where:

- Raw bureau data from one country can be translated into the schema of another

- You’re not recreating trust, just transferring it

- APIs help banks evaluate international applicants fairly

- A global financial identity follows you like your email address

Sounds idealistic? Maybe. But with the right standards, consent protocols, and tech stack ,it’s absolutely doable.

And I’d love to contribute to building it.

🤝 An Open Call

If you’re building in this space: cross-border credit, financial identity, API-based score translation, let’s talk. If you’re solving for expats, immigrants, or global citizens, count me in. And if you’ve faced this frustration like I have, drop your story in the comments. Let’s bring visibility to the problem, and maybe even co-create a solution.