Let’s get one thing straight: getting a loan in the U.S. is not for the faint-hearted, heck not even getting an insurance is - It is going to be a while before I'm able to recover from the PTSD of getting an auto insurance but dear reader, this is a story for another day. Keep reading and subscribe to my newsletter for this story @ https://tini.bio/vigneshnaidu

Coming back to lending, its not because the interest rates are scary (they can be), or because paperwork is overwhelming (it definitely is) but because your credit score is the ultimate judge, jury, and loan approval engine. It's like your financial Tinder profile. And if your score’s not hot, the bank’s just not that into you.

Coming from India, where credit underwriting has evolved from collateral-based to behavioral scores, from field agent appraisals to alternate data it was fascinating (and occasionally baffling) to decode how Americans borrow money.

So let’s dig in.

💳 1. Types of Loans in the U.S.

The lending buffet here is vast. Each loan product comes with its own set of rules, regulations, and rituals. Here’s the highlight reel:

🏠 Home Loans (Mortgages)

The American Dream™ is incomplete without a 30-year mortgage. Fixed-rate, adjustable-rate, jumbo loans , you name it. Mortgage rates are heavily influenced by the Federal Reserve, and pre-approvals are practically a pre-requisite before house hunting.

Contrast with India: Indian home loans usually span 15–20 years, and floating interest is the norm. In the U.S., you can lock in your rate for decades. And refinancing is practically a sport.

🚗 Auto Loans

Here, the dealership is also your financier. You walk in for a test drive and walk out with a loan. Loan tenures range from 3 to 7 years, and interest rates vary wildly depending on your credit score. There is heavy competition or if you are buying a Tesla, you can even get a loan at 0% interest rate (talk about what declining sales can make a company do!)

Contrast with India: In India, loans are typically routed through banks or NBFCs and require more documentation. Here, if your credit’s decent, you can finance a car faster than you can say “I miss Uber Auto.”

🧑🎓 Student Loans

These are...a saga. Many Americans carry student debt well into their 40s. Federal loans, private loans, subsidized/unsubsidized you need a course just to understand your student loan structure. Some times they may be forgiven but don't count your luck on it!

Contrast with India: Education loans are rising in India but are still largely collateral-backed and parent-sponsored. In the U.S., the student is expected to carry the burden and often the regret.

💰 Personal Loans

Unsecured loans used for everything from home renovation to debt consolidation. Fintech players like SoFi, Marcus, and LendingClub are giving traditional banks a run for their money literally.

Fun fact: APRs can range from 6% to 35% and yes, that top end stings.

India comparison: Personal loans are more relationship-driven. A healthy salary slip and decent credit score can unlock quick funds. And let’s not forget the ubiquitous gold loan, a uniquely Indian product you’ll never find in Palo Alto.

💳 Credit Cards as Loans

This deserves a category of its own. Revolving credit is a way of life here. Many Americans routinely carry balances on credit cards, which are essentially unsecured loans with double-digit interest rates.

🔐 Secured vs. Unsecured Lending

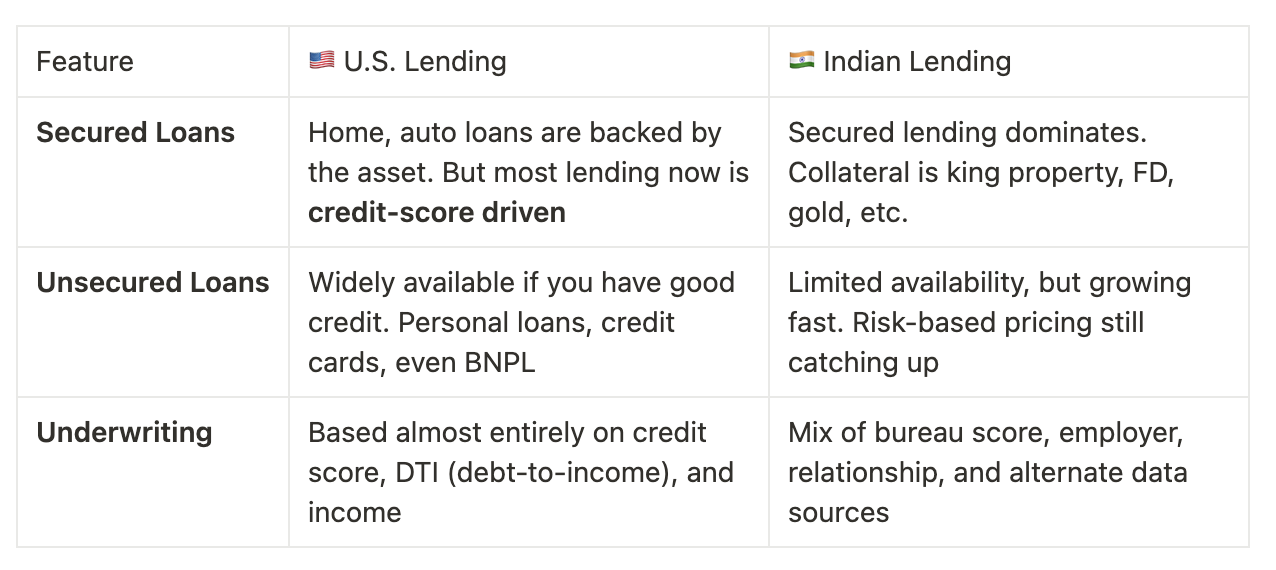

This is where the contrast with India really pops.

In India, your past relationship with the bank matters. In the U.S., your FICO score and income documentation are everything. It’s like walking into a room where nobody knows your name, just your number.

📊 Cultural & Behavioral Differences

- Co-signers & joint accounts: In the U.S., many young borrowers need a co-signer. In India, we call that person “Dad.”

- Loan stacking: Americans often juggle multiple loans at once: auto loan, student loan, two credit cards, and a mortgage. This would give an Indian branch manager palpitations.

- Prepayment penalties: Still common in U.S. mortgages. In India, RBI made these largely illegal for home loans. Our regulator isn't half bad now, is it.

- Refinancing culture: U.S. borrowers refinance aggressively, especially for mortgages and student loans. In India, loan transfers are more bureaucratic.

🧭 Final Thoughts

Lending in the U.S. is built around trusting the credit system. It’s efficient, algorithmic, and brutally fair: if your credit score is high, doors open. If not, you’re locked out with no one to escalate to.

Coming from India, where underwriting blends judgment with data, it feels both elegant and unforgiving. But that also makes it ripe for innovation.

Neobanks, alt-lenders, and credit builders are trying to reshape the game here and as someone who’s seen both worlds, I can’t wait to dive deeper.

In my next post, I’ll explore how Americans build credit, how that compares with India’s evolving bureau ecosystem, and why I sometimes still dream of CIBIL reports.

Until then, may your interest rates be low and your approvals be high!